Advertisement

-

Published Date

August 1, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

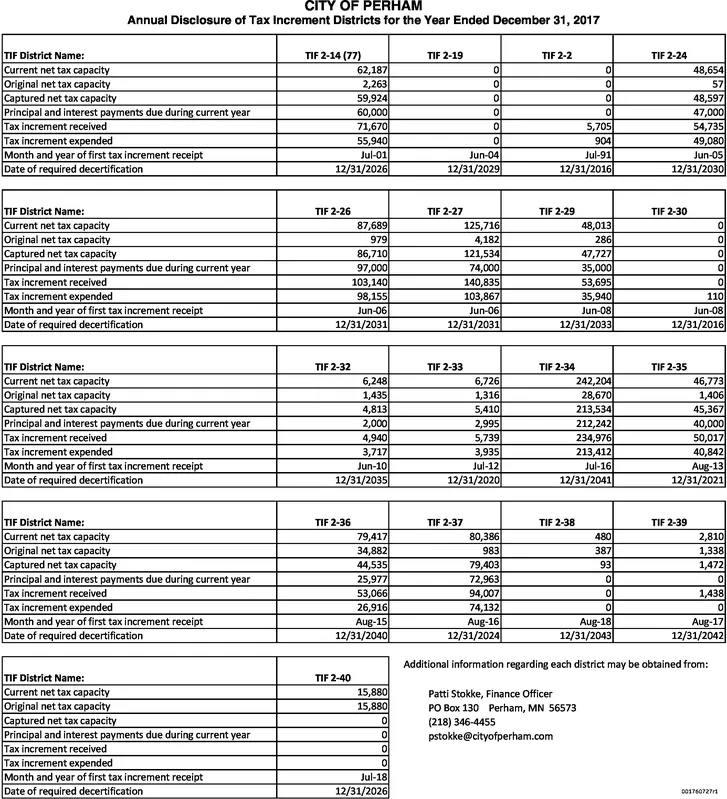

CITY OF PERHAM Annual Disclosure of Tax Increment Districts for the Year Ended December 31, 2017 TIF 2-24 TIF District Name: Current net tax ca Original net tax cap Captured net tax capa Principal and interest payments due during current year Tax increment received Tax increment expended Month and year of first tax increment receipt Date of required decertification TIF 2-14 (77) TIF 2-2 62,187 60 904 Jul-91 12/31/2016 49 12/31/202 12/31/203 TIF District Name: Current net tax ca Original net tax capa TIF 2-26 TIF 2-27 TIF 2-29 ty 125,716 Principal and interest payments due during current year Tax increment received Tax increment expended Month and year of first tax increment recei Date of required decertification 74,000 103,867 12/31/2031 47,727 35 53,695 35 98,155 Jun-06 12/31/2031 110 Jun-08 TIF District Name: Current net tax ca Original net tax capaci Captured net tax capac TIF 2-32 TIF 2-33 TIF 2-34 TIF 2-35 242,204 46,773 1,316 2,000 3,717 12/31/2035 213,534 212,242 234,976 213.412 40 Tax increment received Tax increment expended 40,842 Date of required decertification 12/31/202 12/31/2041 12/31/2021 TIF District Name TIF 2-36 TIF 2-37 TIF 2-38 TIF 2-39 urrent net tax capacity Original net tax capacity 79,417 34,882 44,535 25,977 480 1,338 Principal and interest payments due during current year Tax increment received Tax increment expended Month and year of first tax increment receipt 72,963 74,132 12/31/2040 12/31/2024 12/31/2043 12/31/2042 Additional information regarding each district may be obtained from TIF District Name: TIF 2-40 Patti Stokke, Finance Officer PO Box 130 Perham, MN 56573 (218) 346-4455 pstokke@cityofperham.com Original net tax capacity Principal and interest payments due during current year Tax increment received Tax increment expended Month and year of first tax increment receipt Date of required decertification Jul-18